unitop Pension

The end-to-end pensions administration system

Designed for retirement funds and pension schemes

Are you looking for a comprehensive pensions administration system to help you administer pension recipients and future recipients in the most effective possible way? If so, you’ve definitely come to the right place! With unitop Pension, we can provide you with an end-to-end software solution that allows you to set up your pensions administration in the most effective possible way. Our solution is based on Microsoft Dynamics 365 Business Central and was designed specifically for occupational and company welfare and pension scheme providers (such as pension funds and supplementary pension funds). With unitop, you can overcome the challenges that exist in your sector in an efficient and future-proof way.

unitop Pension

Comprehensive pensions administration for pension and welfare schemes & pension funds

As an integrated software package that includes specialist, sector-specific functions, unitop Pension covers all of the core processes carried out by occupational and company welfare and pension scheme providers.

unitop Pension is a software package for pensions administration that operates on the Microsoft Dynamics 365 Business Central platform, the standard software package developed for businesses, in combination with additional Microsoft products.

Whether your requirements are centred on administering members or pension recipients, a calculation engine, paying agency notification procedures, the digital pension overview or portal connections, our many years of experience in the sector have enabled us to develop dedicated functionalities to serve the specific needs of retirement pension and welfare scheme providers as effectively as possible.

With unitop, we provide you with an innovative, future-proof and scalable solution that is optimally equipped to meet new requirements and offers you maximum security on your investment.

Whether your needs and concerns relate to IT compliance, data protection or supervision by the Federal Financial Supervisory Authority – with unitop Pension, you will always be on the safe side: dedicated functions and interfaces are developed, proactively modified and adapted in compliance with the latest legal requirements.

Comprehensive. Sector-specific. Sustainable.

A single pensions administration system with everything included

As an end-to-end solution, unitop Pension includes everything you need to ensure your processes are performed smoothly:

Administration of members & future recipients

Digital contract management & much more

Under “Administration of members & future recipients”, we include all categories of persons you interact with during the contributions phase, whether they are currently working, or are future recipients, employees, members, insured persons or others. To help you administer your members and future recipients, unitop Pension provides you with an integrated address management system (a type of CRM). To help you administer future recipients and members, the solution includes various functionalities that will take your processes to a whole new level:

Our solution includes a comprehensive range of master data management functionalities to make your day-to-day work easier: our in-house role centre helps you perform all processes relating to handling of cases involving your active contacts. The foundation of the master data management solution is the integrated address management system (CRM), which GOB has enhanced by adding sector-related fields and functions. You can also access a range of process management functionalities. To assist you in the most effective way, these use pre-defined workflows for tasks such as creating new future recipients. You also have a complete overview at all times, thanks to the visual display showing how far individual actions have progressed.

The integrated functionalities for application management and document management will help you process all types of application. For example, you can manage an application for an early retirement pension efficiently by assigning tasks and activities to individual process steps. Documents to be submitted can be scanned and placed in the digital dossier.

If you need to send correspondence to your members and future recipients, you can now rely on the correspondence function. In just a few clicks, you can access saved text modules to create complex mass mailings from within the software itself. You can also create and adapt the relevant templates yourself. You can also save any correspondence sent in the integrated document management system, view it at any time and, if necessary, re-use it. Alternatively, you can use Microsoft Word for correspondence purposes, of course.

The future recipient and member administration role is also useful for managing contributions in every way, including the administration of all entitlements and/or commitments. The integrated, tried-and-tested subledger functions equip you with a wide range of useful options, such as debit position, SEPA payment transactions using automatic direct debiting, automatic entry for self-payers by importing electronic bank statements, outstanding items administration and a reminder system. All you need to do is configure the functions in line with your own individual requirements.

Thanks to a provider interface, electronic contribution notifications from your sponsoring undertakings can be imported so that contribution processing is as fully automated as possible. unitop Pension automatically allocates contribution notifications and the associated payments to the correct future recipients to the fullest possible extent, considerably reducing the amount of work and effort involved in reconciling contributions.

As part of the integrated contract management functionality, the contributions collected from future recipients are allocated in the form of contribution entries, which will ultimately lead to contributions-based entitlements. Debit positions and allocated payments are displayed as accounts receivable entries in the subledger of the accounts receivable accounting. Parties paying contributions may actually be employers or sponsoring undertakings, but can also be self-payers. The entries are made regardless of whether the main accounting facility in unitop Pension is actually being used.

Administering complex contractual constructions made simple

In Germany, the landscape of pension and welfare scheme providers is extremely complex and varied. While pension and welfare schemes are administered with a high degree of flexibility, that flexible nature inevitably poses a number of challenges. Using our comprehensive pensions administration system, you can master complex tasks with one hand tied behind your back – in unitop Pension, complex contractual structures can be administered easily, multiple status types can be displayed simultaneously and the ability to obtain and provide information is guaranteed across the entire organisation.

Administration of pension recipients & benefits

Pension simulation, calculation engine, retirement & more

In unitop Pension, the integrated pension recipient and benefit administration functionality includes all processes specific to the sector. These include various functionalities that make light work of the challenges that come with the complex processes you carry out every day:

As part of the roles concept, the pension recipient and benefit administration functionality in unitop Pension can be vested in a dedicated user role. Depending on the structure of the organisation, this means that administrative tasks can also be taken over by another department and therefore by different case workers to the ones administering members and future recipients.

If one member of staff is acting on behalf of another due to absence, the same case worker can carry out the processing by simply expanding the user role and the associated permissions. unitop Pension adapts itself to your individual working method and organisation.

Alongside an expanded master data upkeep functionality for the recipients of pensions and other types of benefit and a facility to manage multi-stage status information, additional specific processes are also displayed. This means that the retirement process is carried out using a dedicated retirement transfer, which guides the user through the system step by step. When transferring a member from a contribution scheme to an annuity contract or while performing the transfer function carried out following a death (surviving relatives pension), wizards are also used to assist the case worker and to ensure that no step of the procedure can be forgotten.

By processing these tasks in the form of workflows, approvals can be given using the ‘two-pairs-of-eyes’ principle (Internal Verification System (IKS)).

Pensions are calculated and administered via the contract management functionality available in unitop Pension. For each type of pension, body of rules and/or pay scale type, a dedicated calculation logic is saved in a self-contained calculation engine. The calculation engine is used to calculate the pension and also to produce projections for pension simulations.

The administration of pension entitlements and pension payments is based on the pension entries assigned to a pension contract. This then serves as a basis for the credit entries and ultimately for the pay-out made to the pension recipient using the integrated payment transactions functionality. As part of that process, the credit entries in unitop Pension form the basis for compiling the SEPA payment file for the pensions.

As is also the case when administering members and future recipients, you can manage multiple status types and multiple contacts per pension and benefit recipient, as this will make the resulting display simpler and more transparent. The solution is also capable of administering both contribution contracts and annuity contracts for one and the same person. This makes it possible for one person to be simultaneously listed in the subledger functions as a debtor and a creditor, without causing dual entries.

The ongoing administration of certificates of life and the use of the function to reconcile data concerning deaths, child benefits, capital settlements, pledging and also pension rights adjustments can also be displayed in unitop of course.

In unitop Pension, a pension rights adjustment is recorded as a procedure of its own, according to the type of adjustment involved, and is accompanied by all of the necessary master data. It can also be calculated within the software solution itself. Thanks to the flexible configuration of the solution, you can take individual calculation parameters for the pension rights adjustment into account in the calculation engine.

All master data relating to persons entitled to receive a pension rights adjustment and to those obliged to carry out one are clearly displayed for the case worker, together with the underlying proportions that apply based on the length of the marriage. The correspondence function, including the document management system, is also available to you in this part of the solution. That way, issuing correspondence such as information letters to the court or to the party entitled to a pension rights adjustment can be managed in just a few steps.

DASBV

Employers’ notification procedure (DASBV) for occupational welfare & pension scheme providers

The DASBV collective receiving office for use by occupational welfare and pension institutions is represented in unitop Pension. Using the fully integrated DASBV function, you can use the established employers’ notification procedure and exchange data electronically in a legally compliant way.

The DASBV function is based on the interfaces and communication components provided by DASBV GmbH and allows you to share encrypted data. If changes are made to the relevant laws, we will carry out modifications or expansions and will make the up-to-date version available to you in each case. That way, you will always be up to date and on the safe side.

The major advantage for you is that transmission takes place from within unitop, so there is no need to switch to a different software program. This means that you can continue working in the familiar environment and use the many integrated functionalities that have much more to offer than simply calling up and encrypting the data provided by the DASBV:

DEÜV notifications and the contributions collected by employers can be easily imported into unitop Pension from the DASBV, so that they can then be processed automatically from within the solution itself. In this case, you can decide for yourself how you wish to configure the procedure used to receive the notifications. If desired, this can be initiated manually via a separate role centre or can be carried out automatically on a regular, time-controlled basis.

On the one hand, you can use the DASBV function to automatically create an employer together with the corresponding contribution lines, in unitop. On the other hand, you also are able to perform an automatic reconciliation of the reported income using the DASBV function.

The range of functionalities that come with the integrated DASBV function in unitop Pension also includes the processing of voluntary contributions.

Automatically registering and deregistering employment relationships is easy and convenient using the DASBV function of course.

Encrypted electronic data exchange

Paying agency notification procedure

unitop Pension also includes a dedicated function for the paying agency notification procedure. It is ITSG-certified and is responsible for processing the encrypted, electronic exchanging of data with the statutory health insurance funds. Complex, fault-prone interfaces to third-party programs are no longer needed. You can continue working without interruption in the environment you are used to, without having to switch back and forth between various software programs.

ZfA-compliant transmission of master data

Pension benefits notification procedure

In unitop Pension, the procedure that is used to transmit the pension benefits notification to the Central Benefits Agency for Retirement Assets (ZfA) is displayed as an integrated function. Complex interfaces to third-party programs are no longer required.

The “Pension benefits notification” and “Automated application procedure” interfaces are controlled via a dedicated role centre. This helps to create increased transparency and a high degree of control over the outcome.

Do you need to transmit relevant master data (name, date of birth, the pension amount, the annual contribution, the adjustment amount included, etc.) or to carry out an automated procedure for requesting the identification number for welfare providers and active members? The “Pension benefits notification” function that forms part of unitopPension means that many useful, automated functions are close at hand. Identification numbers, responses and corrections concerning error notifications sent by the ZfA are imported into the master data sets and their plausibility checked.

The “Pension benefits notification” function is based on the communication handbooks and defined communication scenarios provided by the Central Benefits Agency for Retirement Assets (ZfA). If changes are made to the relevant laws, we will carry out modifications or expansions and will make the up-to-date version available to you in each case.

Integrated & tested

Financial accounting

As an end-to-end solution, unitop Pension includes integrated and tested financial accounting functionality. Certified functionalities mean that you can carry out your main accounting and subledger activities in the most efficient possible way. This will result in increased transparency during processing and a considerable reduction in the amount of work required to administer your processes.

The financial accounting functionality in unitop has been tested by the accounting firm BDO AG and corresponds to the accepted accounting principles (GoB). We will be pleased to provide you with the certificate, if requested.

Whether you are using it to for internal or external accounting, our comprehensive pensions administration system helps you carry out all of your processes and provides you with a reliable controlling tool. Thanks to the integrated fixed asset accounting functionality, you can professionally administer your tangible and intangible assets in accordance with the current requirements under commercial and taxation law.

The main accounting functionality enables you to administer multiple financial clients. You can consolidate clients and also exchange documents electronically between clients. unitop also supports you securely and reliably when compiling the electronic financial statement.

Debtor and creditor management and payment transactions are also processed within the solution. SEPA Requests-to-Pay are also fulfilled to completion in this way. Budget management, liquidity forecasts and comprehensive financial reporting complete the financial accounting functions included.

In addition to cost-centre and cost-unit accounting, unitop Pension offers you a reliable controlling tool that enables you to evaluate as many dimensions (e.g. cost centres, cost units, region, campaign, etc.) as you wish. You can combine the individual dimensions hierarchically so that they correspond as closely as possible to your specific cost-accounting requirements. What is more, you can set a budget for each dimension to make planning your accounts more convenient.

Fixed asset accounting enables you to professionally administer your tangible and intangible assets in accordance with the current requirements under commercial and taxation law. The entire life cycle of an asset can be viewed at the press of a button – regardless of whether this relates to acquisitions, appreciation, depreciations or special depreciations. You can calculate acquisitions by simulating various scenarios using planned assets. In our concept, fixed asset accounting also serves as a foundation for administering securities and real-estate properties.

DMS

Document management

With unitop Pension, you automatically receive a document management system based on Microsoft-SharePoint. This will help you administer and maintain all documents that form part of your pension and welfare institution. When using and allocating all relevant documents, you can compile and manage electronic dossiers for your current and future pension recipients. The document management system also provides some additional benefits:

Portal connection interface

Connecting a portal

As a state-of-the-art pensions administration system, the standard version of unitop Pension already offers you a configured web-service interface to connect a portal for your current and future pension recipients. In addition to the purely technical side of the connection, all additional processes and workflows are taken into account within the interface. You can also use it to connect your sponsoring undertakings and employer companies via a portal, thereby increasing the degree of automation even further. Nothing will stand in the way of your digital transformation to ensure that the self-service approach is implemented as effectively and efficiently as possible for your current and future pension recipients and sponsoring undertakings.

Not operating a portal as yet, but considering introducing one? Don’t worry! We will help you turn your plan into a reality – by providing a tried-and-tested portal from one of our long-standing partners. This portal has been used many times before and includes many core processes as standard, for example:

If desired, the functions provided as standard can be customised and expanded in line with your requirements.

Innovating. Transforming. Succeeding.

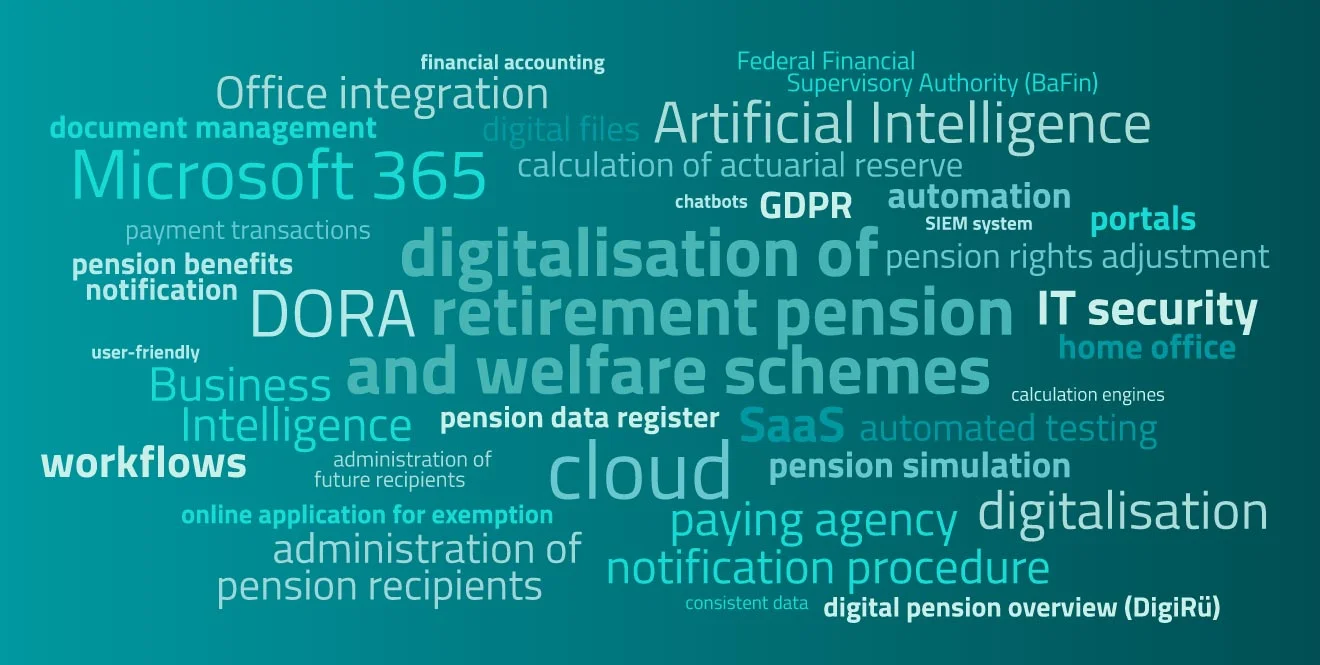

Pension and welfare schemes in the digital age – the unitop pensions administration system has everything under control

The requirements placed on welfare and pension scheme providers and pension funds are becoming increasingly complex all the time, which can quickly lead to overload amongst your personnel. By digitalising your sector-specific processes, you will not only be reducing the workload of your staff. Automating many of your processes will considerably reduce your administrative burden, increase your organisation’s efficiency many times over and help to reduce your IT costs.

With unitop Pension, you will be acquiring a state-of-the-art, pensions administration system in the form of a standard, scalable software package that covers all of your institution’s core processes. This software solution achieves a high degree of specialisation and displays all core areas, from future recipient and member administration to the administration of current pension recipients, in a holistic way. Individual, freestanding solutions are now a thing of the past: you can control and manage all of your processes within a single solution.

Highly specialised standard software

A standard software package for all pension and welfare scheme providers? Yes, of course!

In unitop Pension, our comprehensive pensions administration system, the core processes are not the only things that play a key role. Integrated Microsoft products (for example, Microsoft 365 or Power BI), embedded general and sector-specific functions (e.g. the administration of pension recipients & benefits, paying agency notification procedures, tested financial accounting, DASBV, DMS, etc.) and on-board interfaces (that enable portals for pension recipients and future recipients to be connected, for example) are also part of the deal. With unitop, you can administer all of your processes easily and conveniently within a single solution, while sustainably reducing the costs of internal reconciliation.

The best thing of all is that the software aligns itself with your specific requirements and, if needed, can be flexibly adapted and expanded. Third-party solutions – such as a main accounting system already in place – can also be connected, if desired.

Do you have any questions or would you like to find out more about unitop Pension? We’ll be pleased to advise you!